In the financial world, your clients are trusting you with their future. Whether you are a chartered accountant, an insurance broker, or a wealth manager, the way you manage information defines your success. A Financial CRM like Zoho CRM acts as a secure vault for your client data, helping you track investments, manage documents, and provide high-quality advice without getting buried in manual work.

Using Wealth Management CRM Software allows you to spend less time calculating data and more time building relationships that last for generations.

Common Challenges: Why Finance Professionals Struggle Without a CRM

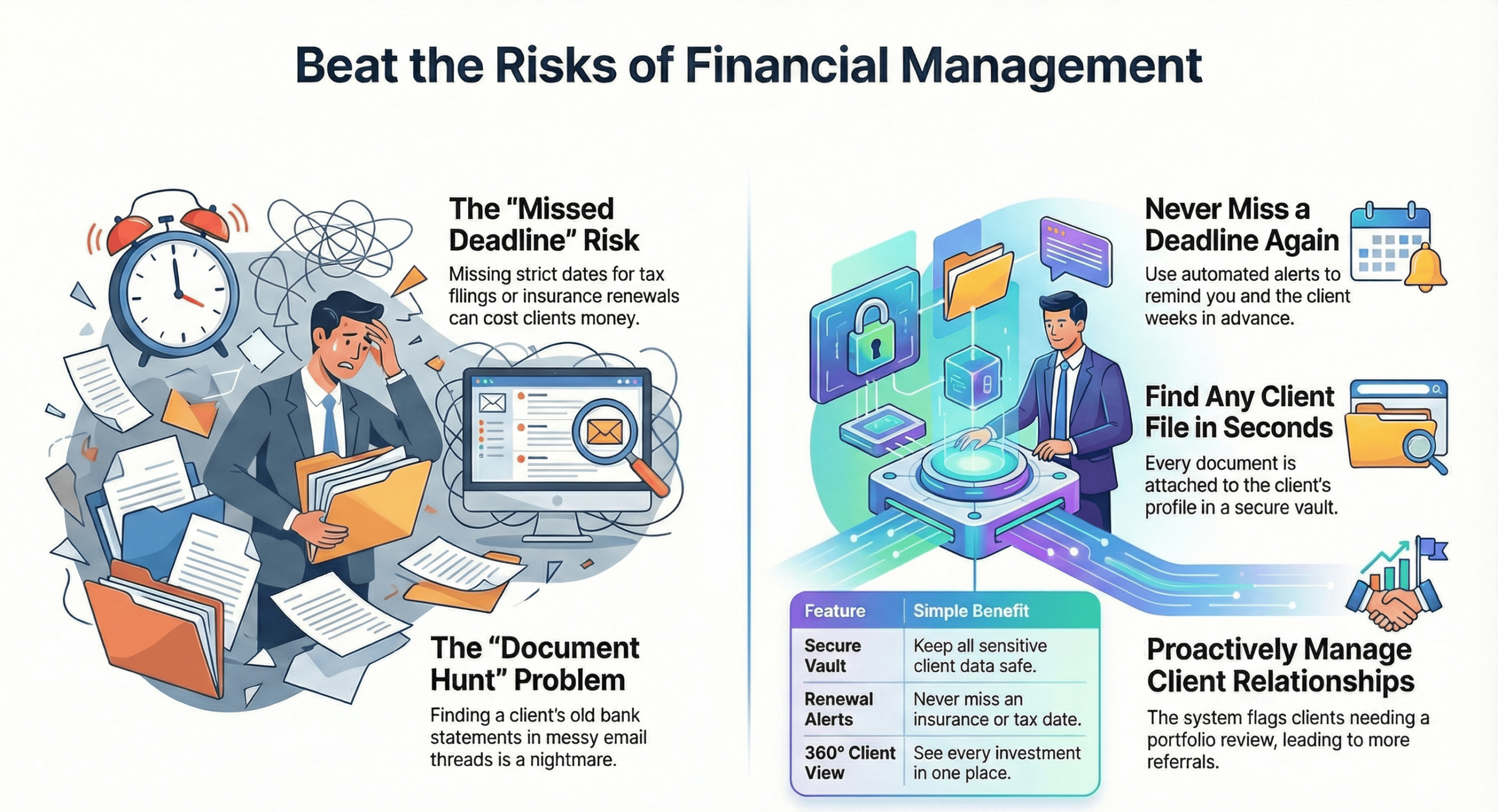

Handling money involves a lot of moving parts. Without a dedicated Financial CRM, professionals often face “The Three Risks” that can hurt their reputation.

1. The “Missed Deadline” Risk

-

The Struggle: Tax filings, insurance renewals, and investment reviews have strict dates. Missing one can cost a client money and lead to penalties.

-

The Zoho Solution: Use Financial Lead Tracking and automated alerts to ensure you never miss a deadline. The system reminds you—and the client—weeks in advance.

2.The “Document Hunt” Problem

-

The Struggle: When it’s time for an audit or a loan application, finding a client’s old bank statements or ID proofs in a messy email thread is a nightmare.

-

The Zoho Solution: Every document is attached to the client’s profile in your Wealth Management CRM Software. You can find any file in seconds, even while talking to the client on the phone.

Managing the Client Journey (The Financial Service Funnel)

Providing financial advice is a long-term journey. Zoho CRM helps you manage this Financial Service Funnel from the first meeting to long-term wealth growth.

Onboarding New Clients with Ease

-

The Feature: Use digital forms to collect client details and financial goals.

-

The Benefit: Instead of hours of paperwork, the Financial CRM captures the data and creates a profile automatically. It makes you look professional and organized from day one.

Automated Portfolio Reviews

The best advisors are proactive, not reactive.

-

The Feature: Set up the system to flag clients who haven’t had a portfolio review in six months.

-

The Benefit: This proactive Client Relationship Management ensures your clients always feel like you are looking out for their best interests, which leads to more referrals

A Simple Example: “BlueChip Financial Advisors” in Action

Let’s look at how a simple finance firm uses these primary and secondary keywords to stay organized.

-

Lead Discovery: A potential client searches for “Retirement Planning” and finds your website. They fill out a contact form.

-

Instant Greeting: The Financial CRM sends them a “Getting Started” guide and a link to schedule a discovery call.

-

The Meeting: During the call, the advisor uses the Wealth Management CRM Software to record the client’s risk appetite and long-term goals.

-

The Plan: The advisor sends a customized financial plan. The CRM tracks when the client opens the document, letting the advisor know the best time to call and follow up.

-

Ongoing Trust: Every year on the client’s birthday and on their investment anniversary, the CRM sends a personalized note, keeping the relationship strong.

Key Benefits of Zoho CRM for Finance

| Primary Feature | Simple Benefit | Keyword Category |

| Secure Vault | Keep all sensitive client data safe. | Financial CRM |

| Renewal Alerts | Never miss an insurance or tax date. | Financial Lead Tracking |

| 360° Client View | See every investment in one place. | Wealth Management CRM Software |

| Task Automation | Let the system handle the boring paperwork. | Financial Service Funnel |