In the insurance business, you aren’t just selling a policy; you are selling a safety net. Whether you handle life, health, auto, or property insurance, you need a system that keeps your data organized and your clients informed. An Insurance CRM like Zoho CRM acts as your digital agency manager, helping you track leads, manage complex policy documents, and ensure that no renewal date ever passes unnoticed.

Using a dedicated Insurance Agency Management Tool allows you to spend less time digging through paperwork and more time building the trust that drives referrals and long-term growth.

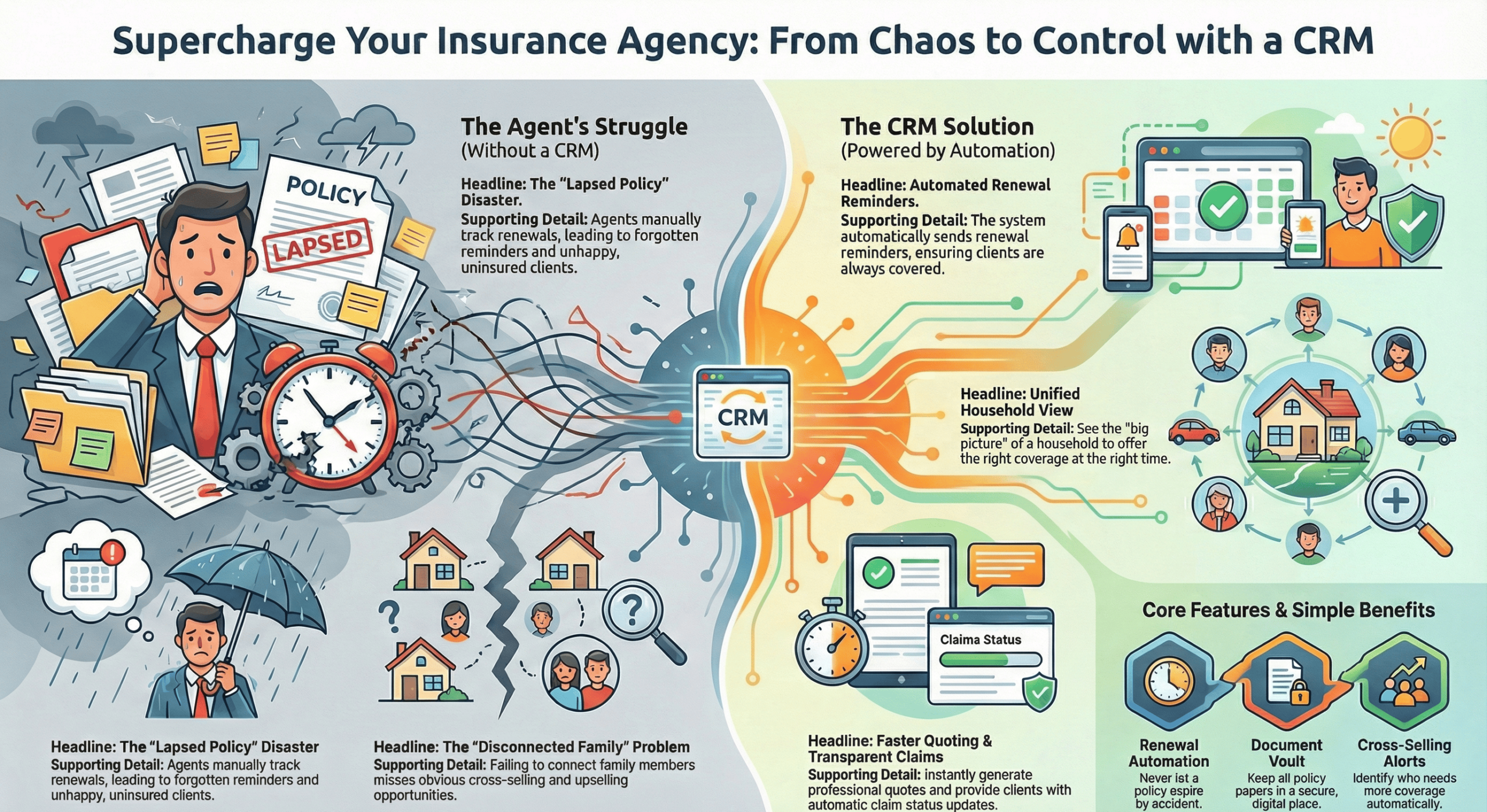

Common Challenges: Why Insurance Agents Struggle Without a CRM

The insurance industry is governed by dates and details. Without a Insurance CRM, small errors can lead to lapsed coverage and unhappy clients.

1. The “Lapsed Policy” Disaster

-

The Struggle: An insurance agent forgets to remind a client that their car insurance expires tomorrow. The policy lapses, the client has an accident, and the agency loses a customer forever.

-

The Zoho Solution: Use Insurance Lead Tracking and automated workflows to send reminders 30, 15, and 7 days before any expiration. The system does the “nagging” for you, so you only have to focus on the renewal.

2. The “Disconnected Family” Problem

-

The Struggle: You sold a health plan to a father, but you have no record that his daughter is about to turn 18 and needs her own policy. You miss an easy sales opportunity.

-

The Zoho Solution: Every family member and their specific needs are saved in one Insurance Agency Management Tool profile. You can see the “big picture” of a household, allowing you to offer the right coverage at the right time.

Managing the Policy Journey (The Insurance Sales Funnel)

Insurance is a recurring business. Zoho CRM helps you manage this Insurance Sales Funnel from the first quote to the tenth renewal.

Fast and Accurate Quoting

-

The Feature: Template-based quotes and document storage.

-

The Benefit: When a lead asks for a quote, the Insurance CRM pulls their data and generates a professional PDF instantly. Speed is key—the first agent to provide a clear quote usually wins the business.

Claims Management and Support

-

The Feature: Case tracking and status updates.

-

The Benefit: When a client files a claim, they are stressed. Use the Insurance Agency Management Tool to send them automatic updates: “We have received your claim,” or “The inspector has been assigned.” This transparency builds incredible loyalty.

A Simple Example: “SafeHarbor Insurance” in Action

Let’s look at how a simple agency uses these primary and secondary keywords to stay ahead.

-

Lead Discovery: A customer searches for “Term Life Insurance” and signs up for a free guide on your website.

-

Instant Warmth: The Insurance CRM sends the guide and a personalized video message from the agent.

-

The Consultation: The agent uses the Insurance Agency Management Tool to record the client’s health history and financial goals during a call.

-

The Policy Sale: The client chooses a plan. The Insurance Sales Funnel tracks the medical check-up status and the final policy issuance.

-

The Value-Add: Three years later, the CRM alerts the agent that the client just bought a new home. The agent calls to offer a bundled “Home + Life” discount, increasing the agency’s revenue.

| Primary Feature | Simple Benefit | Keyword Category |

| Renewal Automation | Never let a policy expire by accident. | Insurance CRM |

| Document Vault | Keep all policy papers in a secure, digital place. | Insurance Agency Management Tool |

| Lead Nurturing | Stay in touch with prospects until they are ready. | Insurance Lead Tracking |

| Cross-Selling Alerts | Identify who needs more coverage automatically. | Insurance Sales Funnel |